Additionally, the Division works closely with the IRS to quickly share information obtained from SIRF investigations and prosecutions, which the IRS can use to make it more difficult for the schemes to be successful by blocking the false claims for refunds from being paid. The Tax Division also implemented expedited procedures for working with the United States Attorneys’ Offices on SIRF crimes to ensure the quickest possible investigation and prosecution of these cases and has worked with United States Attorneys’ Offices, the IRS, and other law enforcement agencies, to establish task forces in areas with a high concentration of SIRF crime. As part of this effort, the Division has established an Advisory Board of experienced prosecutors to develop and implement uniform national policies for fighting SIRF crimes. The nationwide reach of the Tax Division’s centralized criminal tax enforcement and its ability to coordinate closely with every United States Attorney’s Office, and through them with local law enforcement and police, makes it possible for the Government to respond efficiently and forcefully to the explosion of SIRF crimes. Successfully prosecuting the wrongdoers involves a national strategy of information sharing and coordinated prosecution. SIRF crimes cross state borders, and increasingly, national borders.

The SIRF perpetrators arrange to have the refunds electronically transferred to debit cards or delivered to addresses where they can steal the refund out of the mail. Typically SIRF perpetrators file the false returns electronically, early in the tax filing season so that the IRS receives the false SIRF return before legitimate taxpayers have time to file their returns. The IRS was able to stop or recover over $24 billion of that total, or approximately 81% of the fraudulent claims. The IRS estimated that during the 2013 filing season alone, over 5 million tax returns were filed using stolen identities, claiming approximately $30 billion in refunds. However, everyone with a Social Security Number is potentially vulnerable to having his or her identity stolen. For example, SIRF criminals have used Social Security Numbers stolen from hospitals, nursing homes, and public death lists, thereby exploiting some of the most vulnerable members of our communities, including the elderly, the infirm, and grieving families. Identities used in SIRF crimes may be stolen from anywhere.

These criminal enterprises are able to exploit the speed and relative anonymity of highly automated systems for storing personal information, preparing and filing tax returns electronically, and generating income tax refunds quickly-often in the form of electronic payments. SIRF crimes are often perpetrated by large criminal enterprises with individuals at all stages of the scheme: those who steal the Social Security Numbers (SSN) and other personal identifying information, those who file false returns with the Internal Revenue Service (IRS), those who facilitate obtaining the refunds, and the masterminds who promote the schemes.

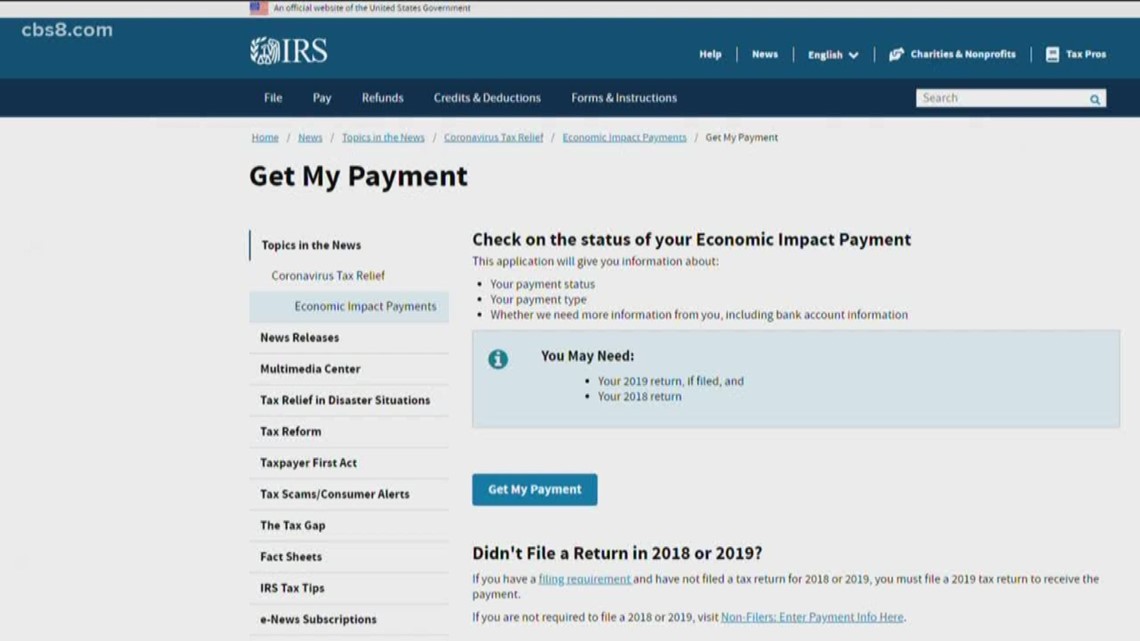

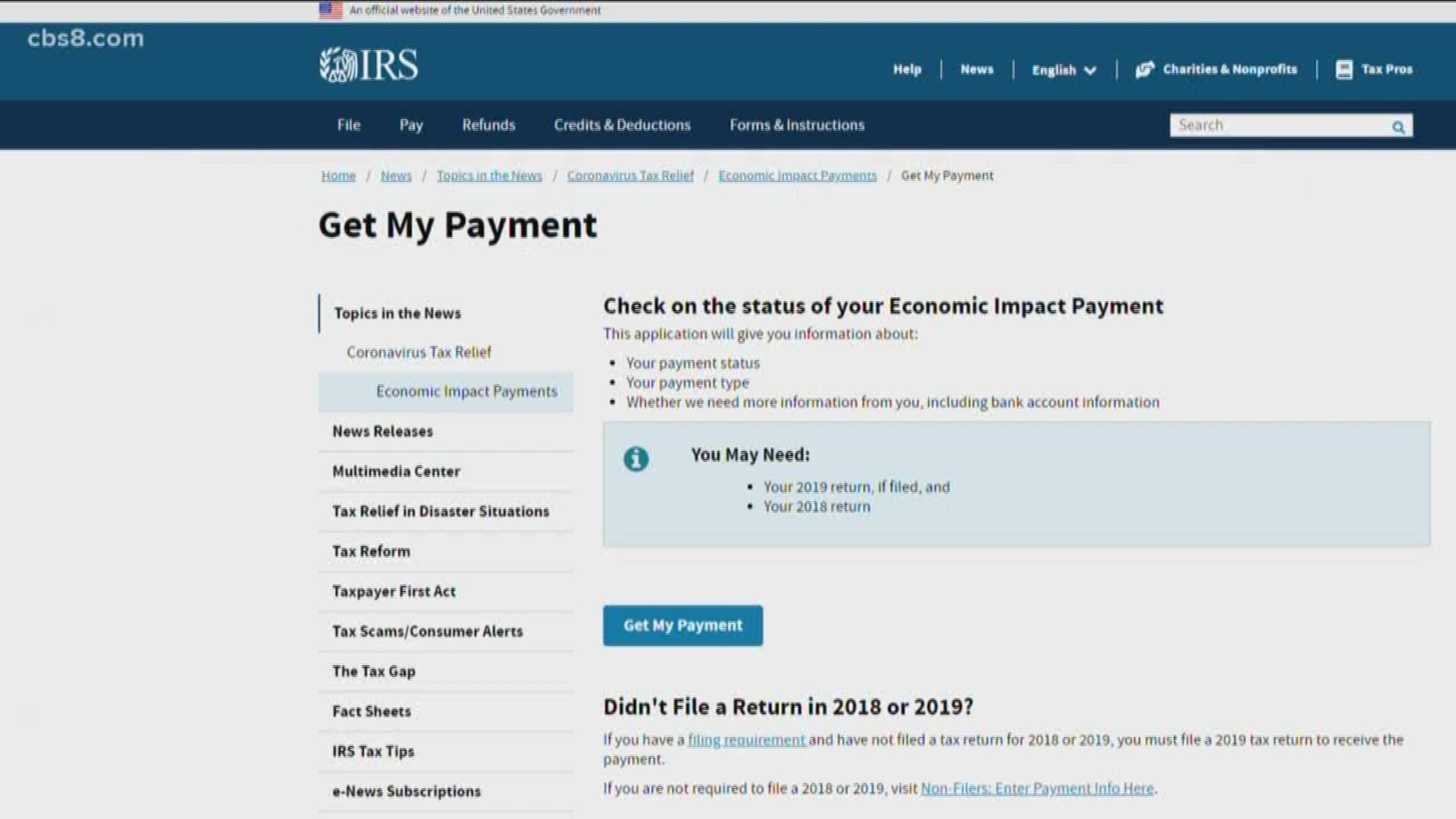

Working to stop Stolen Identity Refund Fraud, or SIRF, is vital because these schemes threaten to disrupt the orderly administration of the income tax system for hundreds of thousands of law abiding taxpayers and have cost the United States Treasury billions of dollars. One of the Tax Division’s highest priorities is prosecuting people who use stolen identities to steal money from the United States Treasury by filing fake tax returns that claim tax refunds. If you know you don’t owe taxes or have no reason to believe that you do, report the incident to the Treasury Inspector General for Tax Administration (TIGTA) at 1.800.366.4484 or at Stolen Identity Refund Fraud (SIRF) Enforcement If you receive a telephone call from someone claiming to be an IRS employee and demanding money, you should consult the IRS Tax Scams/Consumer Alerts webpage. ALERT: The IRS does not send unsolicited email, text messages or use social media to discuss your personal tax issues.

0 kommentar(er)

0 kommentar(er)